Kingsview Minerals Ltd. is pleased to announce that the Company has added to its existing portfolio of mineral exploration properties located in Wawa, Ontario, by acquiring an additional 7,691 hectares (“ha”) in the Michipicoten Greenstone Belt (the “Property Expansion”). Kingsview now controls 11,854 ha, representing one of the largest land packages in this gold-rich region.

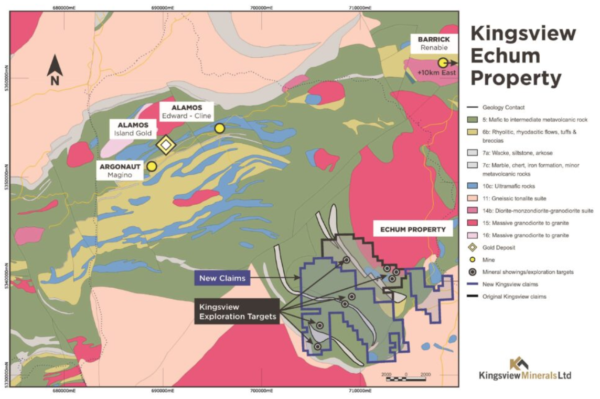

The majority of the claims comprising the Acquired Property (as defined below) connects to and expands the Company’s flagship Echum project (see Figure 1) located north-east of the town of Wawa and adjacent to Alamos’ Island Gold Mine and Argonaut’s Magino Gold deposit. Initial due diligence and early desktop work revealed numerous exploration targets for gold and base metals on the combined property, including known gold-bearing shear zones.

“Wawa is one of the fastest growing gold districts in Canada, and Kingsview is now one of the largest landowners in the area. Major gold occurrences in this district are typically found in greenstones, and we have several greenstone-dominant properties with significant potential, awaiting further exploration,” stated President and CEO, James Macintosh.

As consideration for the Acquired Property, Kingsview has issued 7,500,000 common shares (the “Payment Shares“) to the vendors, pursuant to the terms and conditions of an asset purchase agreement dated April 4, 2022. The Payment Shares will be subject to a hold period of four months and one day in accordance with applicable securities laws.

The issuance of 500,000 Payment Shares to James Macintosh, President, Chief Executive Officer and Director of the Company in connection with the Property Acquisition constitutes a “related party transaction” pursuant to Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 contained in Section 5.5(b) and Section 5.7(1)(b) of MI 61-101, respectively, on the basis that (i) no securities of the Company are listed or quoted on any of the markets specified in Section 5.5(b) of MI 61-101 and (ii) the fair market value of the securities issued to related parties in connection with the Property Acquisition does not exceed $2,500,000, along with the other applicable circumstances contained in section 5.7(1)(b) of MI 61-101.

Wawa-news.com You can't hear the 'big picture'!

Wawa-news.com You can't hear the 'big picture'!