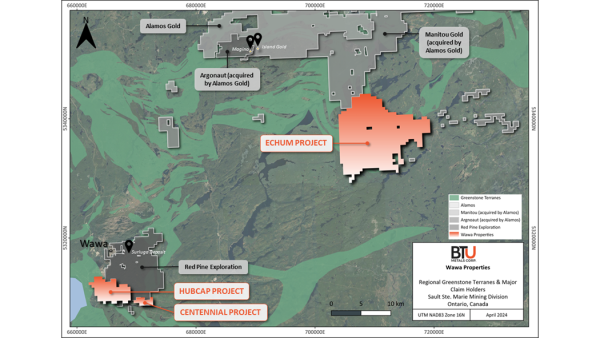

The Company is preparing to follow-up on areas of strong shearing, sulphide mineralization and quartz veining identified in the work programs completed late in 2024 on the northern part of the Hubcap project located immediately south of the Red Pine Wawa Project (Figure 1 above).

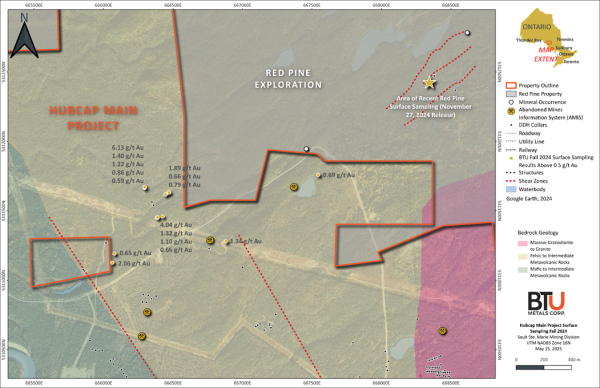

Figure 2: Strongly altered, sheared, and mineralized volcanics with quartz veining in area of recent surface sampling results.

Encouraging results and information from prospecting, geological mapping and a compilation of historic results has allowed the Company to plan and now prepare to execute additional work programs that will include geological mapping, prospecting, and geophysical surveying during the 2025 field season.

The results released by neighboring Red Pine Exploration Inc. (a few hundred metres from the common boundary with Red Pine will be a priority area for initial prospecting in the early part of the program. On November 27, Red Pine released the results of 18 grab samples from the War Eagle area approximately 3km south-southeast of its 2024 Mineral Resource Estimate area that was released in a press release September 30, 2024. Results of the assays from the 18 samples ranged from 0.72 g/t gold to 17.10 g/t with the overall trend of the shears and mineralization indicated to be south-southwest toward the common boundary with the Company approximately 750 metres farther southwest.

Late in the field season last year, prospecting samples were collected near the common boundary on the Company’s side of the boundary from scattered surface exposures of sheared, quartz veined, and carbonate altered outcrop that included disseminated pyrite. Assay values received ranged from trace to 6.13 g/t gold** from mineralized quartz veining and sheared wall rock as shown on Figure 2 (right).

A map with an overview of all Fall 2024 surface sampling results above 0.5 g/t Au is available in Figure 3 (below).

Wawa Area Echum Project

The Company completed an initial six drill hole program on the 100% owned 14,262-hectare Echum Project in Wawa, Ontario. The project is an extensive gold-silver-critical minerals prospect located adjacent to Alamos Gold Inc. (“Alamos”) (AGI-TSX) property that hosts the Island gold mine and the Magino gold mine.

Interpretation of the available geology and geophysical data indicate the overall stratigraphic sequence on the Alamos ground extends southerly to southeasterly onto the Company’s Echum property. Historic work on the Echum property has indicated the presence of both gold and base metal occurrences at several locations and much of the property is overburden covered or has been rather inaccessible due to a lack of road access.

Initial drilling focused on testing anomalies and targets identified in data collected in the 2021 Versatile Time Domain Electromagnetic (VTEM) and 2023-2024 Induced Polarization (IP) surveys. These anomalies have had scarce, if any historic drill testing.

The Company wishes to thank the Government of Ontario and the Ontario Junior Exploration Program (OJEP) for funding in support of advancing the Echum Project. Drill holes were designed to test a number of separate anomalous chargeability features in areas where little geological information existed. Drill core logging revealed some low copper and zinc values as well as the occurrence of significant mineralized quartz veining (with sulphides such as pyrite, chalcopyrite, sphalerite) generally associated with moderate to strong shearing, which may indicate the presence of regional scale deformation zones. No significant gold values were found in the core samples analyzed.

Drilling to date at the Echum Project intersected anomalous near-surface copper and zinc mineralization and confirmed strong correlation with VTEM and IP anomalies. Notably, some features of the wide mineralized zone appear visually similar to gold systems elsewhere in the Wawa gold district, such as Alamos’ Island Gold Mine, suggesting potential for the discovery of gold mineralization on the property in new locations as well as in the area known as the Ballard Lake gold occurrences, an area explored historically. The Company has yet to compile and carry out work in this area. The six holes drilled in late 2024 and early 2025 tested only to a maximum depth of 200m, and totaled only 807 metres. Ongoing interpretation of the complex structures intersected will enhance the understanding of the Echum Project, where multiple additional targets remain to be tested.

Sample Preparation & Analysis

All drill holes were logged, sampled, photographed, and cut at a secure logging facility in Shining Tree, Ontario. All samples were cut using a Vancon core saw, and the top half was collected and placed in sample bags secured with zip ties with unique sample IDs. The samples were delivered to AGAT Laboratories facility in Sudbury, Ontario, and were prepared and analyzed in Thunder Bay, Ontario and Calgary, Alberta.

A description of the sample preparation and analysis methods are listed below:

- Samples were crushed to 75% passing 2mm, split to 250g.

- Samples were pulverized to 85% passing 75 microns.

- Gold analysis was carried out by 50g fire assay with atomic absorption spectroscopy (AAS) finish (AGAT method code 202-551).

- All samples were also analyzed using the metal package by 4-acid digest, with an ICP-OES finish (Inductively Coupled Plasma – Optical Emission Spectroscopy), AGAT method code 201-070.

The following QAQC procedures were used:

- One (1) Blank and one (1) Certified Reference Material (CRM) inserted into the sample stream every twenty (20) core samples

- CRMs OREAS-236 and OREAS-238 were selected for use in the drill program

- A minimum of two (2) BTU personnel received all AGAT Laboratory assay certificates

- There were no failures identified in the QAQC assay results

The Company also announces it has set 4,300,000 options to directors, officers and consultants at $0.05 for a period of two years in accordance with the Company’s stock option plan.

- The Boob Bus is Back! - February 19, 2026

- Saint-Joseph School receives donation from Wildwood Bakehouse - February 18, 2026

- L’école Saint-Joseph reçoit un don de Wildwood Bakehouse - February 18, 2026

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News