Dec 18, 2015

Once in a while, everything lines up, and things make sense. Wawa-News invites its readers to see if they can connect the dots as well.

It began with the Council Meeting of November 17th, 2015. In that meeting Councillor Liddle questioned a number of professional fees that were part of the October 2015 Expenditures. This had come forth as part of the meeting’s agenda for approval from Council. CAO Wray explained that those ‘professional fees’ were payments for tax registration services provided by Real Tax. From their website:

Realtax is the most highly qualified, highly experienced team of tax registration and tax sale professionals in Ontario. Since our inception in 1996, we have served 200 municipalities. We have assisted them with: 20,000 properties, 2,500 tax sales and $2 million in payments out of court.

Realtax is the most highly qualified, highly experienced team of tax registration and tax sale professionals in Ontario. Since our inception in 1996, we have served 200 municipalities. We have assisted them with: 20,000 properties, 2,500 tax sales and $2 million in payments out of court. Council had received a report on September 28th to discuss the tax arrears and vacant buildings, and at the November 10th meeting, 6 weeks later that report was discussed and would be revisited in the new year to determine better methods to address tax arrears.

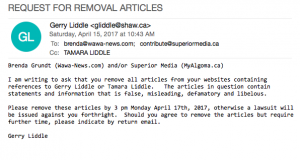

So curious to read this report, which had been presented to Council at a public meeting, Wawa-news filed a Freedom of Information Request for the report on November 19th, the tax registrations disbursements, and querying if Whiskey Jack Ridge Bed & Breakfast / Tamara Liddle had a business licence.

That FOI went before Council “in camera” on December 10th. At 7:10 p.m. I received the Tax Arrears report, and was advised that the “October disbursements listing will be sent the next day. I actually received them on the 14th. I received the entire October 2105 Accounts, with information not pertinent to my request redacted (blacked out). 38 registration fees of 452.00 ea was paid to ? (the name was redacted).

However, from the discussion during the November 10th meeting – it is clear that it was for professional services/tax registrations on those properties. One of the properties, was to my surprise, the residence owned by Tamara and Gerry Liddle. The tax arrears certificate shows that the property is over three years in municipal tax arrears. The amount of arrears is not important, only that the process of tax registration has taken place; and that a tax sale may occur unless the entire amount owing is paid within a year of registration.

ExpenditurePage-redacted Tax-CertificateRedacted

Please note that I have redacted the other roll numbers, and have also redacted the financial information contained on the Tax Certificate. The amount owing is not necessary to this, merely the fact that the property is in arrears is.

That is now where we begin to connect the dots.

Councillor Liddle has declared a conflict of pecuniary interest with items discussed in camera over the past few months. For example:

- November 3rd – Personal Issue (1 item), Property Tax Matter, personal matters about an identifiable individual (Municipal Act, c.25, ss.239 (2) (b))

- November 10th – Legal Item (1 item), Property Tax Matter, personal matter about an identifiable individual (Municipal Act, c.25, ss.239 (2) (b))

However, Councillor Liddle did not declare a conflict:

- when the report on Municipal tax arrears and discussion about what measures could be taken to affect a more effective collection of taxes from ratepayers was discussed.

- when she challenged CAO Wray’s continuing with the tax registration process – when her family home was directly involved. Trying to subvert or change that process is a direct conflict.

- when she did not declare a conflict with the FOI request that referenced her directly, “Does Whiskey Jack Ridge Bed & Breakfast / Tamara Liddle have a business licence?”. Council has yet to release information regarding that question. As of the time of this report, the answer Wawa-news is that the request is “pending”.

So what next? It would appear that Councillor Liddle has had conflicts of interest and participated in discussions of those matters. Recognising and declaring a conflict of interest is on the onus of the individual only. That said, members of Council are also counselled that it is better to declare a conflict if you think you are – it is better to declare than not.

Making a complaint to the Integrity Commissioner could lead to only a slap on the wrist. Readers may remember Councillor Ken Martin. In 2010, for the first and second code of conduct complaints, Councillor Martin was suspended for a total of 30 days suspension of his remuneration as councillor, 15 days for each complaint. For the third code of conduct breach, Councillor Martin was suspended 30 days of his remuneration. For the fourth code of conduct complaint, Councillor Martin was suspended for 60 days of his remuneration as councillor.

There is no indication at this time as to what the future will bring. This certainly does cast a shadow on a Council that has said ‘openness and transparency’ was needed.

- Thursday Morning News – February 19 - February 19, 2026

- Wednesday Morning News – February 18 - February 18, 2026

- Bus Cancellations – Batchawana Eastwards - February 18, 2026

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News