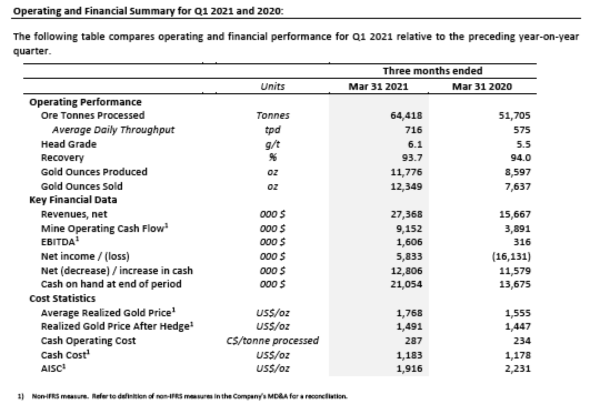

Harte Gold announced its results for the three months ended March 31, 2021.

Q1 2021 Operational Highlights:

- Gold production: Total production of 11,776 oz Au for Q1 2021, a 9% increase over the previous quarter.

- Average monthly production totaled 3,925 oz Au for the quarter.

- Mine capital development: Averaged 14.0 metres per day, an increase of 23% over Q4 2020.

- Ore tonnes processed: Average throughput rate of 716 tonnes per day (“tpd”) for the quarter, an increase of 42% over Q4 2020.

- Head Grade: 6.1 g/t Au, within 10% of target for the quarter.

Q1 2021 Financial Highlights:

- Revenues: $27.4 million in revenue from 12,349 ounces sold in Q1 2021 ($15.7 million and 7,637 ounces respectively, in Q1 2020).

- Net Income: $5.8 million in Q1 2021 (loss of $16.1 million in Q1 2020).

- Mine Operating Cash Flow1: $9.2 million in Q1 2021 ($3.9 million in Q1 2020).

- Gold hedge impact: Incurred a $4.3 million expense in Q1 2021 ($1.1 million in Q1 2020) for the settlement of 8,341.3 ounces hedged. Average Realized Gold Price1 after hedge in Q1 2021 was US$1,491/oz (US$1,447 in Q1 2020).

- EBITDA1: $1.6 million in Q1 2021 ($0.3 million in Q1 2020). • Cash Cost1: US$1,183/oz in Q1 2021, (US$1,178/oz in Q1 2020). • AISC1: US$1,916/oz in Q1 2021, (US$2,231/oz in Q1 2020).

- Mine Capital development: $6.3 million invested in Q1 2021 ($6.0 million in Q1 2020).

- Enhanced Shareholder Base: On March 24, 2021, the Company closed an investment by New Gold Inc. (“New Gold”) for net proceeds of $23.7 million.

- Liquidity position: Cash on hand at March 31, 2021 was $21.1 million ($8.2 million at December 31, 2020). Based on the Company’s updated outlook and guidance for 2021, the Company will require additional funding within the next few months. The Company’s liquidity position is further discussed below under “Liquidity and Capital Resources”.

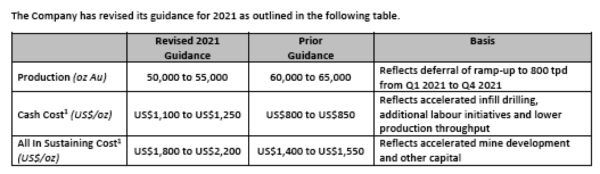

Revised 2021 Outlook and Guidance

While positive production advances experienced over the prior two quarters continued in Q1 2021, based on an analysis of recent learnings and the continued operational challenges faced as well as the additional mitigative measures being implemented (as discussed below), the Company is now forecasting that quarterly growth will occur at a lower rate than what was previously planned for 2021. This increased timing expected to achieve stabilization at 800 tpd has negatively impacted 2021 guidance.

Achieving a steady-state ore mine production rate of 800 tpd, representing approximately 5,200 ounces per month, continues to be the Company’s main priority to stabilize the operation and provide the launching platform to the subsequent expansion to 1,200 tpd in 2023. The Company’s updated view, assuming the acceleration of some life-of-mine capital, is that the targeted ore mine production rate of 800 tpd will only be achieved in late Q4 2021.

The above guidance on AISC reflects the Company’s current best estimate but remains subject to ongoing analysis, especially with respect to the costs associated with the mitigation measures discussed below. The Company is continuing to review its prior guidance for Mine Development ($26 million), Other Capital ($13 million) and Regional Exploration ($5 million) and will provide updated guidance to the market when available.

Recent Insights:

In late 2020, a system for tracking key operational metrics was established to provide us with the ability to better monitor and analyze operational performance. During Q1 2021, this data was continually evaluated although the trends were not evident until more recently. Our key findings include:

- significantly higher than planned labour workforce shortfalls (approximately 20%) and a much longer than anticipated timeline to filling vacancies;

- ongoing definition drilling completed to date, critical to increasing the understanding of the orebody, has, in some areas, resulted in changes to portions of the 2021 mine plan grade and tonnage assumptions and, in other areas, the identification of new economic mineralization outside of the planned reserves;

- the negative impact the condition of our mobile equipment is having on production; and

- much longer than planned lead time to obtain critical components.

Over the course of the past two weeks, we have been working on translating what these challenges mean for 2021. Ultimately, we have determined that achieving 800 tpd of ore at near mineral reserve grade will only occur later in the year. The impact of a shortfall of approximately 10,000 recovered gold ounces in 2021 (resulting from the change in production guidance to 50,000 to 55,000 ounces from 60,000 to 65,000 ounces) creates a revenue shortfall of approximately $22 million. The impact on the Company’s liquidity due to the loss of this revenue is compounded by a mostly fixed operating cost base, ongoing sustaining capital deployment, the commencement of some expansion capital and a debt repayment of US$3.3 million to BNP scheduled for June 30, 2021. Despite the Company’s current capital constraints, the 1,200 tpd expansion, which would generate an average annual gold production of close to 100,000 ounces, continues to be the ultimate objective for 2023.

Mitigation Measures:

To mitigate factors currently impacting the previous 2021 guidance and the subsequent 1,200tpd expansion, the Company is taking the following steps to de-risk planning, significantly increase mine flexibility and unlock potential additional ore tonnes.

- Thursday Morning News – April 25th - April 25, 2024

- Wednesday Morning News – April 24 - April 24, 2024

- Winter weather travel advisory – ENDED - April 23, 2024

Wawa-news.com You can't hear the 'big picture'!

Wawa-news.com You can't hear the 'big picture'!