Last week, Manulife, Canada’s largest insurance company, made headlines across the country by telling customers that coverage for 260 specialty prescription drugs would only be filled at Loblaw-owned pharmacies, chiefly Shoppers Drug Mart. It was a move that was roundly and swiftly condemned by independent pharmacies, health care groups, unions, and consumers across Canada. That condemnation forced Manulife to quickly backpedal and announce they would reverse course on this foolhardy idea in about a week. But how did we get to this point, how would this deal affect consumers, and what can we do to prevent it from happening again?

Last week, Manulife, Canada’s largest insurance company, made headlines across the country by telling customers that coverage for 260 specialty prescription drugs would only be filled at Loblaw-owned pharmacies, chiefly Shoppers Drug Mart. It was a move that was roundly and swiftly condemned by independent pharmacies, health care groups, unions, and consumers across Canada. That condemnation forced Manulife to quickly backpedal and announce they would reverse course on this foolhardy idea in about a week. But how did we get to this point, how would this deal affect consumers, and what can we do to prevent it from happening again?

The deal initially struck between Manulife and Loblaw-owned pharmacies is nothing new, although it tended to be more of an issue in the U.S., where the relationship between insurers and specific chains is a little cozier. It’s what is known as a preferred pharmacy network. Essentially, an insurance company would work out some form of deal with a pharmacy, in exchange for a lower cost for the insurance company. While some insurers in Canada already have some form of preferred pharmacy network, most are voluntary, meaning that customers may see some savings by going to a specific retailer recommended by the insurer, but could still fill their prescription at any pharmacy. The Manulife-Loblaw deal was different in that it was exclusive, preventing patients the choice of pharmacy.

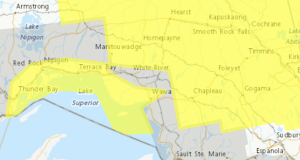

As soon as the news of this arrangement became public, New Democrats called upon the Competition Bureau to investigate Manulife and Loblaws for anti-competitive behaviour. Manulife relented, clearly as a result of the negative press and general disdain from Canadians they were receiving on this deal. It would have forced some customers to have to go to multiple locations to fill their prescriptions. And for people in rural communities, like a lot of people in Northern Ontario, it may have meant that they would need to drive some distance just to get the drugs they needed. The drugs included fell under the umbrella of Manulife’s Specialty Drug Care program, which includes drugs for conditions such as rheumatoid arthritis, multiple sclerosis, Crohn’s disease, pulmonary arterial hypertension, osteoporosis, some cancers, and hepatitis C.

It’s hard to fathom how deals like this will ever be to the benefit of the consumer. Large corporations like Loblaws are the ones who have the money, resources, and lobbyists to ink deals with large insurers. While Manulife was clearly cutting this deal to save money, there is no indication that any part of this deal specifically benefited the cost borne by those filling prescriptions. However, deals like this, while unpopular, are perfectly legal everywhere except Quebec, where preferred pharmacy arrangements between pharmacies and insurance providers are prohibited.

One of the issues we find ourselves in is the depths of the lobbying arm of companies like Manulife and Loblaws. In the past two years, the Liberals have been lobbied by Loblaws 60 separate times. Jenni Byrne + Associates, owned by the Conservative leader’s senior advisor, is a registered lobbyist for Loblaws in Ontario. Lobbying and competition rules should be designed with the best interests of Canadians in mind, not corporations. Bills like C-352, which increases penalties for anti-competitive acts and prohibits mergers from proceeding if they result in excessive combined market share, could help stamp down on issues like this.

Canadians’ access to life-saving drugs should not be up to a few mega-corporations to decide. If properly developed, the Canadian pharmacare plan, which is part of the Supply and Confidence Agreement, could possibly prevent similar deals between insurance companies and large retail chains from happening in the future. Keeping the profiteering of large corporate entities at bay will depend on the government’s willingness to create a strong pharmacare program. A single-payer model that puts the health and wellbeing of patients ahead of lining the pockets of huge corporations is what Canadians deserve.

- Reflecting on the Challenges and Accomplishments of 2024 - December 19, 2024

- Carol Hughes – CRA Hack Needs a Thorough Investigation - November 13, 2024

- Carol Hughes – Is it Time to Get Tougher on Residential School Denialism? - November 5, 2024

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News