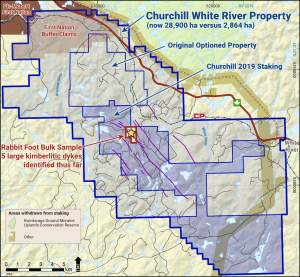

Further to its news release dated March 6, 2023 announcing the exercise of an existing option to acquire a 100% interest in certain mineral properties with prospective diamond targets plus potential nickel and lithium targets located immediately west of the town of White River, Ontario, Churchill Resources Inc. announces that it has agreed to settle an outstanding debt in the amount of $50,000, representing an annual advance royalty owing to the vendors of the Properties under the terms of an existing option and purchase agreement, by issuing an aggregate of 555,555 common shares of the Company at a price of $0.09 per Common Share to the vendors. The Board of Directors has determined it is in the best interests of the Company to settle the outstanding Debt by the issuance of the Common Shares in order to preserve the Company’s cash for ongoing operations.

Further to its news release dated March 6, 2023 announcing the exercise of an existing option to acquire a 100% interest in certain mineral properties with prospective diamond targets plus potential nickel and lithium targets located immediately west of the town of White River, Ontario, Churchill Resources Inc. announces that it has agreed to settle an outstanding debt in the amount of $50,000, representing an annual advance royalty owing to the vendors of the Properties under the terms of an existing option and purchase agreement, by issuing an aggregate of 555,555 common shares of the Company at a price of $0.09 per Common Share to the vendors. The Board of Directors has determined it is in the best interests of the Company to settle the outstanding Debt by the issuance of the Common Shares in order to preserve the Company’s cash for ongoing operations.

Closing of the Shares for Debt Transaction is subject customary closing conditions, including the prior approval of the TSX Venture Exchange. The Company intends to close the Shares for Debt Transaction as soon as practicable following receipt of the approval from the TSXV. The Common Shares to be issued pursuant to the Shares for Debt Transaction will be subject to a statutory hold period of four months and one day from the date of issuance.

- Mixed Curling Standings – February 10 - February 10, 2026

- Accelerated Mining Supervisor Common Core launches this spring - February 6, 2026

- Les élèves de l’école secondaire Saint‑Joseph fabriquent leurs propres mocassins - February 6, 2026

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News