What is the real reason behind rising auto insurance rates in Peel and the rest of the province?

According to a former Brampton MP, the answer has to with the province, not insurance companies.

Former Brampton West MPP Vic Dhillon disclosed the surprising truth earlier this week during a wide-ranging interview regarding insurance coverage, benefits and more.

Ontario has some of the highest auto insurance rates in the country, though this has been tempered in recent months by the uncertainty surrounding the COVID-19 pandemic, which has caused lower driving rates and relief measures for customers.

In a new report released last week by Lowest Rates, a study found that car insurance prices in Ontario were down about 4 per cent year-over-year, but experienced a 2 per cent quarter-over-quarter increase, largely due to claims costs in the province rising steadily, along with high rates of insurance fraud.

The minimum coverage in Ontario is $200,000 third party liability plus Accident Benefits, per the Statutory Accident Benefits Schedule. This means drivers are purchasing the $200,000 third-party liability, plus: $50,000 in medical coverage for most injuries (increases to $1,000,000 for catastrophic injuries).

104 weeks of income replacement coverage are set at 80 per cent of a driver’s gross income to a maximum of $400 weekly for most injuries .

The GTA has high rates, but rural Ontario is much less expensive.

According to the insurance companies and studies, Brampton’s rates are extremely high in Canada because of a high insurance fraud rate.

The provincial government has been threatening to regulate the industry for years.

But recently, Former Brampton West MPP Vic Dhillon disclosed the hidden truth behind Ontario’s high auto rates. Even a small per cent reduction would create a massive tax hole in the provincial finances, said Dhillon, who stated that false claims are “just a small tip of the iceberg.” Moreover, insurance companies are able to claim, and do claim, tax deductions for fraud claims. Dhillon says that the real part of the problem is the provincial government itself.

“It does not matter which political party forms the government; insurance premium increases remain imminent as the government desperately needs more and more tax revenue,” Dhillon explained. Dhillon is not the only one drawing attention to the matter of soaring premiums. NDP Auto Insurance Critic Tom Rakocevic made repeated requests earlier this summer for the province to stop premium gouging on Ontario residents.

“Instead of getting a discount on auto insurance that reflected the decrease in driving and accidents, Ontario drivers got tossed a few bucks or told to downgrade their coverage, and be grateful,” Rakocevic said in July. Dhillon added that MPPs, especially those newly elected, do not know the real reason behind the spiking insurance premiums. Without the proper knowledge, and due to hierarchy pressure, MPPs are unable to resolve it.

Dhillon also said that this is not an issue to be resolved by pointing fingers at the insurance companies because “the real problem is inside the government.” A fact is that without prior approval of the Financial Services Commission of Ontario (FSCO), insurance companies cannot increase the premiums. More insurance premium means more tax revenue for the government. How much difference does it make?

Insurance premium increase (every year) in Ontario is like an indirect tax increase, said Dhillon. Without the approval of the government, the premium cannot be increased. He also added that federal NDP leader Jagmeet Singh failed to help resolve this politicized issue because he did not know what and where the problem was, and the same story is with so many MPPs today.

When asked why he never disclosed this information while he was MPP and member of the Kathleen Wynne government, Dhillon explained that he did not want to lose his job because “(I) had a family to put the food on the table.”

Surjit Singh Flora is a veteran journalist and freelance writer. He is a popular media commentator on current affairs.

Latest posts by This Media Release (see all)

- Thrift Shop Thanks the Community - February 24, 2026

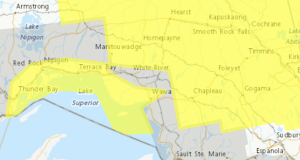

- Bus Cancellations (Wawa, White River & Dubreuilville) - February 24, 2026

- Chiefs of Ontario Urges Immediate Action on Highway Safety After String of Fatal Collisions - February 23, 2026

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News