Sep 20, 2017 @ 08:26

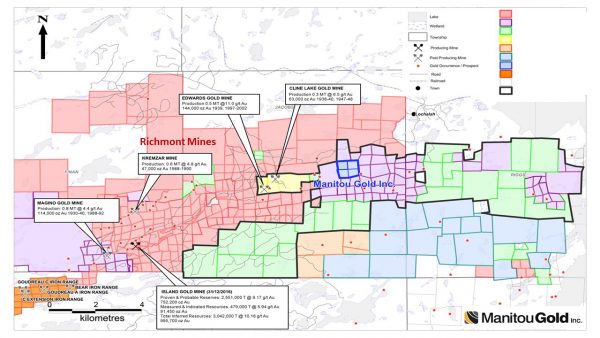

Manitou Gold Inc. nnounces that it has agreed to acquire four parcels of land, each covering approximately 40 acres of patented surface and mining rights (for an aggregate of approximately 160 acres) (collectively, the “Property”), located in Jacobsen Township within the Sault Ste. Marie Mining Division (the “Acquisition”). The Property covers part of the Goudreau –Lochalsh deformation zone which hosts Richmont Mines Island Gold Mine. The Property is situated directly on the part of the deformation zone and lies 2 km east of the past producing Edwards and Cline Mines. The patents covering the Property date back to the 30’s and include surface and mineral rights.

The Property is being acquired in consideration of: (i) the issuance of 200,000 common shares of Manitou; (ii) a cash payment to the vendor (who is arm’s length to Manitou) in the amount of Cdn$60,000; and (iii) the issuance to the vendor of a net smelter royalty of 1% on production generated on the Property (which may be purchased at any time by the Company by making an aggregate cash payment to PASF in the amount of Cdn$1,000,000). The Acquisition remains subject to standard closing conditions, including a satisfactory title review by Manitou.

“This acquisition gives us an initial foothold in the evolving Goudreau Gold Belt” stated Richard Murphy, CEO of Manitou. “I look forward to our initial appraisal of the Property, which will commence this fall”

The Company also announces that the preparation of the draft closure plan in support of future work at its 100% owned Kenwest Property is progressing very well. It is anticipated that the draft closure plan will be submitted to the Ministry of Northern Development and Mines at the end of this month. The Company plans to be in a position to commence advanced exploration on the project in 2018. Currently plans are being reviewed to initiate an interim exploration program designed to provide technical inputs for the bulk sample design as well as to test some new geologic targets of the Kenwest # 2 Shear zone.

Manitou also announces that it has closed the second and final tranche (the “Second Tranche”) of its previously announced private placement (the “Offering”), to raise additional gross proceeds of $42,500. In connection with the completion of the Second Tranche, the Company issued 500,000 units (each, a “Unit”) at a price of $0.085 per Unit. Each Unit consists of one common share of Manitou and one half of one common share purchase warrant, with each whole warrant entitling the holder thereof to acquire one additional common share of Manitou at an exercise price of $0.13 per share for a period of 24 months from the date of issuance thereof. All of the securities issued and issuable in the Second Tranche are subject to a statutory hold period expiring on January 19, 2018.

In total, the Company issued an aggregate of 7,559,000 Units pursuant to the Offering to raise aggregate gross proceeds of $642,515. No finders’ fees were paid in conjunction with the Offering. Proceeds from the Offering will be used to advance the Company’s Ontario projects and for general working capital purposes.

The Offering and the Acquisition each remain subject to the receipt of all applicable regulatory approvals.

- Tenaris Commits an additional $78,500 to Support HSCDSB STEAM Lab Programming - February 21, 2026

- Safety Reminder: Keep Children Off Snowbanks Near Power Lines - February 21, 2026

- Une élève de Wawa exerce son leadership au Sénat des élèves du CSC Nouvelon - February 20, 2026

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News