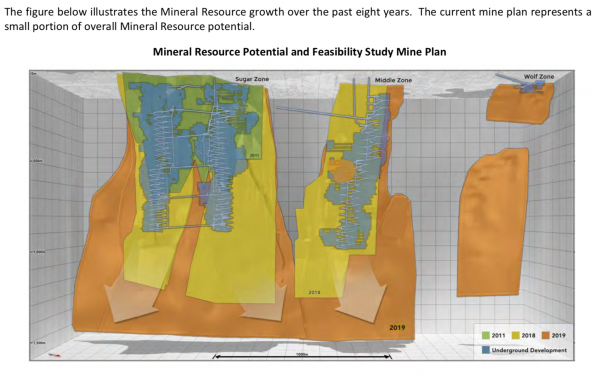

Harte Gold has announced the results of their feasibility study for the Sugar Zone Mine located just north of White River.

This study declares reserves of 3.9 million tonnes at 7.1 g/t Au, net of mining dilution of 38%, containing 890,000 ounces of gold. A base case scenario forecasts a 14 year mine life producing 61,000 ounces of gold annually, generating approx $30 million annually (gold at $1,300/oz). Harte Gold notes that the Mine and Ore Processing Plant is operational with no addtional capital expenditures needed. A cash operating cost US$643/oz and all in sustaining cost (“AISC”) of US$845/oz is used in this feasibility study.

Should the Ore Processing Plant expand from the current rate of 800 tpd to 1,200 tpd production could increase to 95,000 gold ounces annually and potentially reduce cash costs through benefits of scale.

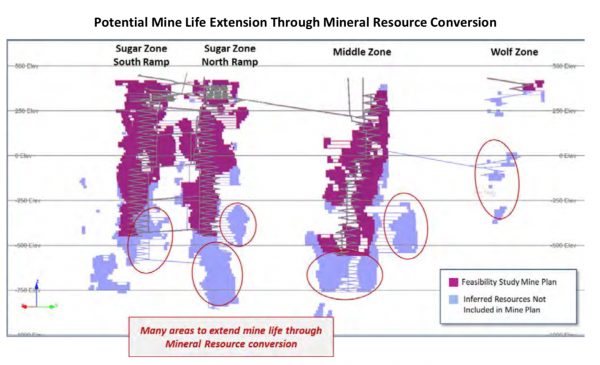

There are two significant opportunites identified. The conversion of near mine exploration targets could extend mine life and reduce mining development cost per tonne of ore processed. The study recommends that, “While there is no certainty that Inferred Mineral Resources will be converted to Mineral Reserves, the Sugar Zone Mine has many such areas to be explored. Historically, infill drilling has successfully converted lower grade Inferred Mineral Resources to higher grade Indicated Mineral Resources.”

The installation of a leach circuit to process flotation concentrate on-site could also reduce costs and increase payable gold ounces. Currently a rougher flotation concentrate is produced at the site, and then transported to the Horne Smelter in Rouyn, QC for further processing. By installing this leach circuit, the leach would be concentrated, reducing the requirement to process the concentrate off site.

Stephen G. Roman, President and CEO of Harte Gold, commented “The Feasibility Study announced today validates the Company’s “Base Case” operating scenario and supports the Company’s longer-term strategy to generate cash flow for continued exploration and Mineral Resource growth on the Sugar Zone property. The opportunities to expand production and cash flow identified in the Feasibility Study are solid. Since taking over the project in 2009, management has increased the property wide mineralization tenfold. The “Base Case” scenario is an interim step to stabilize production, develop and train the workforce and generate positive returns for shareholders. As the Mineral Resource grows, we contemplate the continuation of our expansion plans as we envisioned in our PEA”.

- Wednesday Morning News – April 17 - April 17, 2024

- Tuesday Morning News – April 16 - April 16, 2024

- Monday Morning News – April 15th - April 15, 2024

Wawa-news.com You can't hear the 'big picture'!

Wawa-news.com You can't hear the 'big picture'!