Red Pine Exploration Inc. announces an updated independent Mineral Resource Estimate, inclusive of an open pit and underground Mineral Resource, prepared by WSP Canada Inc. for the Company’s 100% owned Wawa Gold Project in Ontario.

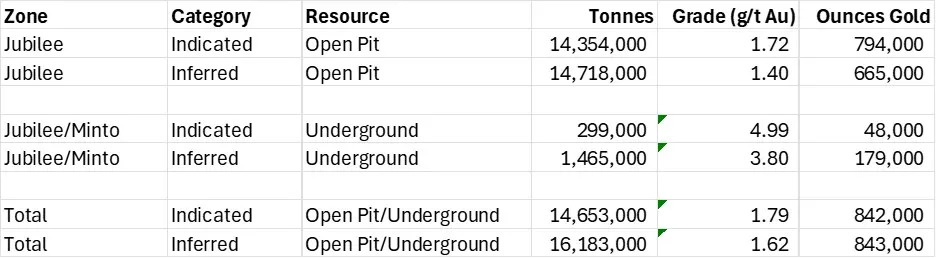

Highlights (Table 1 and Figures 1 to 2)

- The updated MRE has added significantly to the previous 2019 MRE, with an Indicated Mineral Resource of 14.7 million (“M”) tonnes grading 1.8 grams per tonne gold (“g/t Au”) containing 842,000 ounces of gold and an Inferred Mineral Resource of 16.2 M tonnes grading 1.6 g/t Au containing 843,000 ounces of gold, inclusive of both open pit and underground:

- Open Pit:

- Indicated Mineral Resource of 14.3 M tonnes grading 1.7 g/t Au containing 794,000 ounces of gold for the Jubilee deposit; and

- Inferred Mineral Resource of 14.7 M tonnes grading 1.4 g/t Au containing 665,000 ounces of gold.

- Underground:

- Indicated Mineral Resource of 299,000 tonnes grading 5.0 g/t Au containing 48,000 ounces of gold (including the Jubilee and Minto deposits); and

- Inferred Mineral Resource of 1.5 M tonnes grading 3.8 g/t Au containing 179,000 ounces of gold.

- Open Pit:

- The open pit Mineral Resource is constrained within a pit shell above a 0.40 g/t Au cut-off and the underground Mineral Resource is constrained above a 2.0 g/t Au cut-off for Jubilee and 2.4 g/t Au cut-off for Minto.

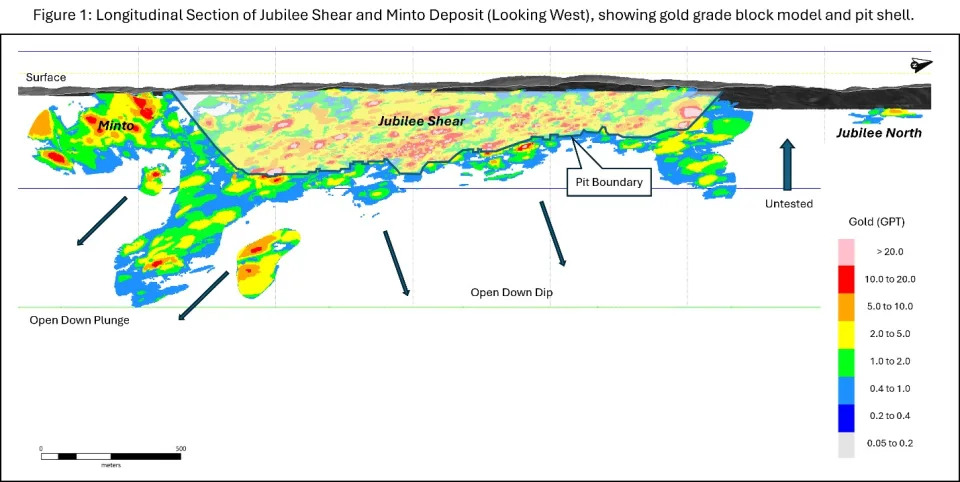

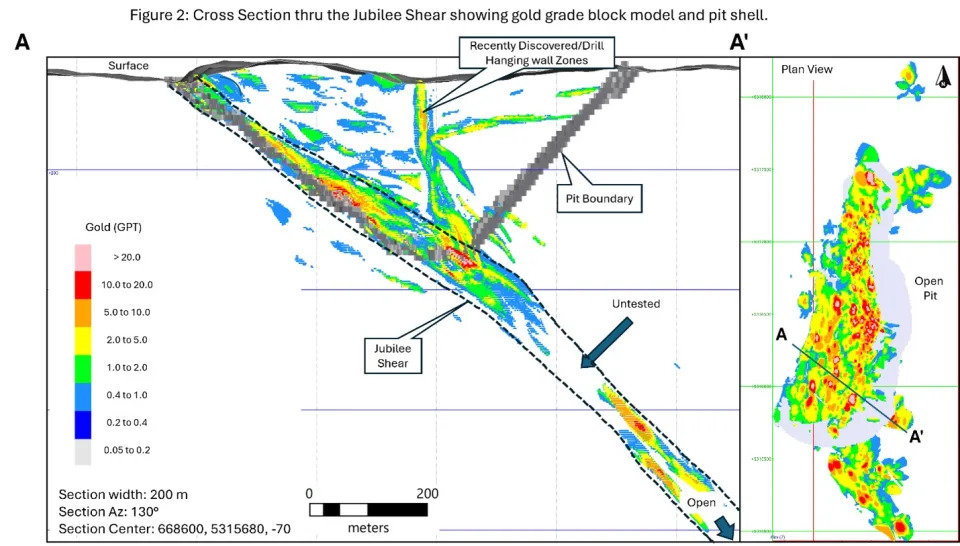

- The deposit is highlighted by continuous gold mineralization starting from surface and extending up to 1,200 metres down dip thus providing optionality for potential future open pit and underground development scenarios:

- High-grade mineralization will be the focus of the near-term exploration program, specifically the down dip and down plunge extensions of the Jubilee and Minto deposits as part of an underground mining scenario.

- The updated MRE shows clear potential for expansion of lower grade mineralization located in the hanging wall of the Jubilee Shear and in the northern extension of the Jubilee Shear that would occur within an open pit scenario.

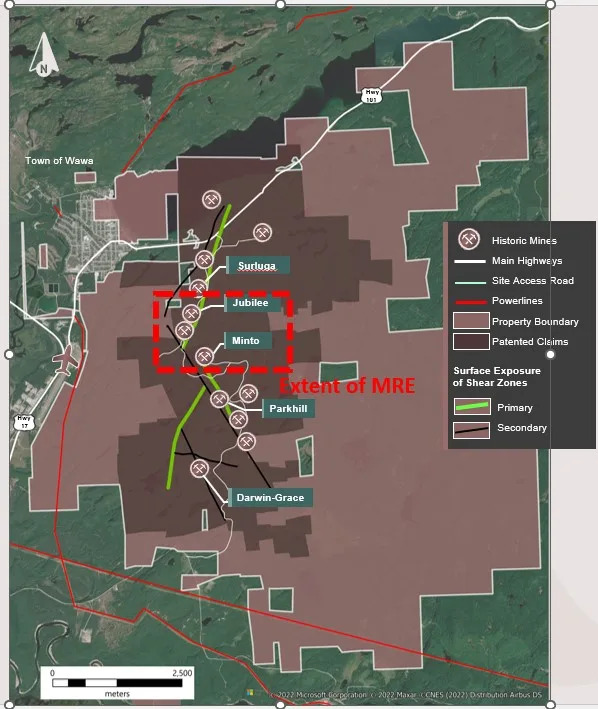

- The updated MRE comprises a small portion of the Company’s land holdings and there remain numerous historic zones and high priority targets elsewhere on the Wawa Gold Project property.

Michael Michaud, President and CEO of Red Pine commented: “We are thrilled to see this increase of approximately 150% in total ounces of gold in the updated MRE. This significant increase validates the approximately 65,000 metres of strategic exploration drilling completed over the past several years. The updated MRE not only shows a material increase in the size of the deposit, but it also significantly increases our confidence in the data and the quality of the deposit and reinforces our vision for a potential high-quality open pit and sizeable higher-grade underground mine. This will provide optionality for any future potential development scenarios.

“We believe the Mineral Resource we have defined today is just the beginning. The latest drill results not only highlight the potential of the Jubilee Shear to host significant gold mineralization over thick sections, but drilling has also confirmed that gold mineralization remains open laterally to the north, and both down dip and down plunge. Any future discoveries in these areas can add substantial value to the Wawa Gold Project, and as such, is a priority for near-term exploration drilling program.

“There also remains numerous exploration targets across the Wawa Gold Project property that remain untested. We plan to include a portion of future drilling programs to test new targets with the intention of making new discoveries to further demonstrate the Wawa Gold Project property’s mineral wealth.”

Mineral Resource Estimate

Mineral Resources are not Mineral Reserves, and do not demonstrate economic viability. There is no certainty that all, or any part, of this Mineral Resource will be converted into Mineral Reserve. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

The updated MRE is set out in Table 1 below.

Notes:

1) The updated MRE described above has been prepared in accordance with the CIM Standards (Canadian Institute of Mining, Metallurgy and Petroleum, 2014) and follows Best Practices outlined by the CIM (2019).

2) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There are no Mineral Reserves for the Wawa Gold Project.

3) The “qualified person” (for purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“)) for the updated MRE is Brian Thomas, P.Geo., an employee of WSP and is “independent” of the Company within the meaning of Section 1.5 of NI 43-101.

4) The effective date of the updated MRE is August 28, 2024.

5) A minimum thickness of 3 metres was used when interpreting the mineralized bodies.

6) The updated MRE is based on sub-blocked models with a main block size of 3 metres x 3 metres x 3 metres.

7) The pit-constrained Mineral Resources are reported at a 0.40 g/t Au cut-off grade considering an Operating Expense (“OPEX”) of CDN $28.95 / tonne ($2.70/t mining, $19.00/t processing, $3.10/t G&A, $3.80/t transport to mill, $0.35/t rehabilitation)

8) The Jubilee underground constrained Mineral Resources are reported at a 2.00 g/t Au cut-off and a minimum of 2,000 tonnes of contiguous material contained within a 1.60 g/t envelope. The 2.0 g/t cut-off assumes underground long hole mining with an OPEX of CDN $146.65 / tonne ($90.00 mining, $37.50 milling, $15.00 G&A, $3.80/t transport to mill, $0.35/t rehabilitation).

9) The Minto underground constrained Mineral Resources are reported at a 2.40 g/t Au cut-off and a minimum of 2,000 tonnes of contiguous material contained within a 2. 00 g/t envelope. The 2.40 g/t Au cut-off grade assumes underground long hole mining with an OPEX of CDN $176.65 / tonne ($120.00 mining, $37.50 milling, $15.00 G&A, $3.80/t transport to mill, $0.35/t rehabilitation).

10) A bulk density factor of 2.77 tonnes per cubic m (t/m3) was applied for the MRE.

11) A gold price of $CDN2,632 (US$1,950) per ounce as used, and a USD/CDN exchange rate of 1.35.

12) Mill recovery of 90.3% was assumed.

13) Royalty of 2.5% (reduced from 3.5% assuming expected re-purchasing of 1.5% of NSR from previous joint venture partner for $CDN1.75 million and option to purchase an additional royalty of 0.5% by Franco-Nevada upon completion of feasibility study).

14) As required by reporting guidelines, rounding may result in apparent summation differences between tonnes, grade, and metal content.

The Wawa Gold Project hosts several gold-bearing structures that, combined, form the Wawa Gold Corridor, a structure that extends for more than 6 kilometres. Since the last MRE in 2019, more than 65,000 metres of drilling has been completed to test near surface mineralization and to better define and extend the higher-grade portions of the Jubilee and Minto deposits. There is now more than 283 km of drilling completed on the Wawa Gold Project that includes resource definition drilling and the limited drill testing of the other exploration targets that are not included in the updated MRE.

Red Pine completed comprehensive data analysis to build high quality lithology, alteration, and structural models which fed the Company’s updated MRE domains and which will guide future exploration programs. The results support a robust open-pit and underground mine plan. The proportion of Indicated to Inferred Mineral Resources has increased substantially, as has our confidence in the data and updated MRE.

Future opportunities include additional metallurgical analysis to optimize mill recoveries as well as geotechnical analysis of core to determine the slope of the open pit walls to minimize waste development. Additional drilling has the potential to define near surface, lower-grade mineralization adjacent to, and in the hanging wall of, the Jubilee Shear to lower waste development in any open pit scenario.

Widely spaced gold intersections in both the Minto and Jubilee Shears, beyond the footprints of the updated MRE, indicate that the structures extend at depth and laterally, that they remain mineralized, and that additional drilling could further expand the Mineral Resource (Figures 1 and 2).

The Wawa Gold Corridor also includes many other gold-bearing structures and historic mines that remain under-explored, including Hornblende/IRG, Mackay Point Mine and northern extension of the Jubilee Shear, Parkhill-Van Sickle, Grace-Darwin, Copper-Ganley, Mariposa, etc. (Figure 3).

Conference Call

The Company will host a conference call at 10:00 a.m. E.T. on Wednesday, September 4, 2024, at which time Michael Michaud, President and Chief Executive Officer of Red Pine will present the findings set out in this press release.

Qualified Person

Brian Thomas, P.Geo. of WSP, is the qualified person, as defined by NI43-101, responsible for the preparation of the updated MRE. Jean-Francois Montreuil, P.Geo. Vice President, Exploration of Red Pine, also a qualified person, as defined by NI43-101, has reviewed and approved the technical information contained in this news release.

About Red Pine Exploration Inc.

Red Pine Exploration Inc. is a gold exploration company headquartered in Toronto, Ontario, Canada. The Company’s shares trade on the TSX Venture Exchange under the symbol “RPX” and on the OTCQB Markets under the symbol “RDEXF”.

The Wawa Gold Project is in the Michipicoten Greenstone Belt of Ontario, a region that has seen major investment by several producers in the last five years. Its land package hosts numerous historic gold mines and is over 7000 hectares in size. Red Pine is building a strong position as a mineral exploration and development player in the Michipicoten region.

Figure 1: Longitudinal section (looking west) of the Jubilee Shear showing grade block model and open pit shell.

Figure 2: Vertical Cross section (looking north) of the Jubilee Shear showing grade block model and open pit shell.

Figure 3: Plan view of the property showing area of the Mineral Resource and other known gold zones.

- GHC Offering Free Cervical Cancer Screening Clinics for Individuals Without a Primary Care Provider - February 28, 2026

- Mixed Curling Standings of February 26 - February 27, 2026

- 2026 Triples Curling Funspeil - February 27, 2026

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News