Mar 21, 2018 @ 12:09

![]() Manitou Gold Inc. announces that it has entered into a binding purchase agreement with Argo Gold Inc. to purchase the property known as the “Rockstar” Property, comprised of 16 unpatented mining claims located in Jacobson and Riggs Townships, Ontario.

Manitou Gold Inc. announces that it has entered into a binding purchase agreement with Argo Gold Inc. to purchase the property known as the “Rockstar” Property, comprised of 16 unpatented mining claims located in Jacobson and Riggs Townships, Ontario.

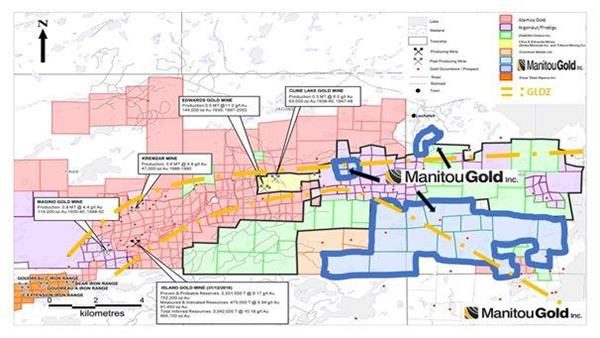

The “Rockstar” Property encompasses an area of 2816 hectares (7,040 acres) and lies within the Goudreau-Localsh Deformation Zone (the “GLDZ”). The GLDZ is an approximately east-west oriented zone of deformation accompanied by quartz veining, alteration and associated gold mineralization. There are numerous past producing mines hosted within the GLDZ.

In recent years, the area has risen to prominence due to gold exploration and development activity. At the west end of the GLDZ, Argonaut Gold is undertaking a pre-feasibility study on its Magino gold property. Just east of Magino is the extensive Island Gold Mine property, which was acquired by Alamos Gold Inc. last November through its takeover of Richmont Mines. Immediately to the east of the Alamos property are the past producing Edwards and Cline Mines respectively. Manitou Gold’s existing Goudreau property is located just to the east of the Edwards and Cline Mines. The “Rockstar” Property is located south and east of Manitou’s Goudreau patented property and covers a large section of the GLDZ (see above graphic).

“I am very pleased that we have been able to secure a much larger landholding on the emerging Goudreau-Localsh gold district,” stated Richard Murphy, CEO of Manitou Gould Inc. “This new property will significantly augment the lands that we acquired in the fourth quarter of 2017. I look forward to uncovering the untested potential of our 100% owned Goudreau properties, as well as that of the large “Rockstar” land position.”

As consideration for the acquisition of a 100% interest in the “Rockstar” Property, the Company is required to make a cash payment of $200,000, and issue an aggregate of 4,000,000 common shares, at a deemed value of $0.12 per share, to the Vendor. In addition, the Company will grant a 1% net smelter royalty to the Vendor at closing, one-half of which may be purchased by the Company for $500,000. The Property is also subject to an existing 2% net smelter royalty in favour of a third party, one-half of which may be purchased for $1,000,000. The acquisition of the Property remains subject to various closing conditions, including the approval of the TSX Venture Exchange.

- Repeat Offender Parole Enforcement Squad would like to locate Troy Foltz - April 23, 2024

- Hydro One reçoit l’autorisation de devenir le fournisseur d’électricité local de la communauté de Chapleau - April 19, 2024

- Hydro One receives approval to join the Chapleau community as the local electricity supplier - April 19, 2024

Wawa-news.com You can't hear the 'big picture'!

Wawa-news.com You can't hear the 'big picture'!