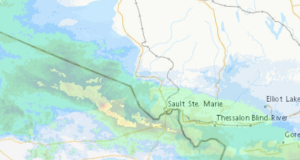

Wesdome Gold Mines Ltd. has sold its Moss Lake Project to Goldshore. Goldshore will acquire all of Wesdome’s property, assets and rights related to Moss Lake. Wesdome purchased the remaining shares in Moss Lake in the first quarter of 2014. In 2016, Wesdome completed the acquisition of mining properties adjoining the Moss Lake property, creating a block of land comprised of 105 unpatented mining claims and two 21-year mining leases comprising 15 patented claims. The mining claims and leases are of irregular shapes and sizes aggregating a total of 3,224.09 ha. An exploration program was conducted in 2016 and 2017 by Wesdome along the strike extension of the Moss lake deposit, and an induced polarization survey over the combined properties traced the potential extensions of pyrite mineralization associated with the Moss Lake Deposit. Moss Lake has been on care and maintenance since the fall of 2017 to allow attention to be focussed on the Eagle River and Kiena Complexes

The media release details that under the agreement, Wesdome will receive minimum initial aggregate consideration of $57M, comprised of the following:

- C$12.5 million in cash upon Closing;

- Shares of Goldshore in an amount equal to the greater of a) $19.5 million and b) 30% of the issued and outstanding common shares at Closing;

- C$20 million in shares of Goldshore in the form of milestone payments consisting of:

- C$5 million within 12 months of Closing;

- C$7.5 million upon the earlier of (i) Goldshore completing an updated PEA or pre-feasibility study; and (ii) 30 months from Closing;

- C$7.5 million upon the earlier of (i) Goldshore completing a feasibility study, (ii) the date on which Goldshore makes a development decision on Moss Lake; and (iii) 48 months from Closing;

- The grant to Wesdome of a 1.00% NSR royalty on all metal production from Moss Lake. Goldshore shall have the right to repurchase the NSR royalty for (i) C$5 million within 30 months of Closing; or (ii) C$7.5 million between 30 – 48 months from Closing. The royalty buyback rights shall expire if not exercised within 48 months of Closing

- Wesdome representation on Goldshore’s Board of Directors with two appointees, Heather Laxton, Chief Governance Officer and Corporate Secretary, and Michael Michaud, Vice President, Exploration

Mr. Duncan Middlemiss, President and CEO, commented, “Wesdome remains focused on advancing our vision of building Canada’s next mid-tier gold producer. The opportunity to advance Moss Lake and bolster our already strong balance sheet, all while retaining meaningful exposure to the project through a strategic equity position as the largest shareholder of Goldshore allows the Company to remain fully focused on our underground high-grade gold mining expertise. This year is pivotal as Wesdome expects to deliver the Kiena Complex into commercial production, expand operations at Eagle as well as move forward on aggressive surface and underground exploration programs at both sites.”

The Transaction is subject to customary closing conditions for a transaction of this nature, including completion of the proposed reverse take-over business combination between Goldshore and Sierra Madre Developments Inc. (resulting in the listing of Goldshore on the TSX Venture Exchange) and receipt of required regulatory approvals. Closing of the Transaction is expected to occur in early Q2 2021.

- Wednesday Morning News – February 18 - February 18, 2026

- Bus Cancellations – Batchawana Eastwards - February 18, 2026

- WFD Responds to Fire on Broadway Avenue UPDATED - February 17, 2026

Wawa-news.com Local and Regional News

Wawa-news.com Local and Regional News